Another great article from Greg Daniels from NOLA Lending

|

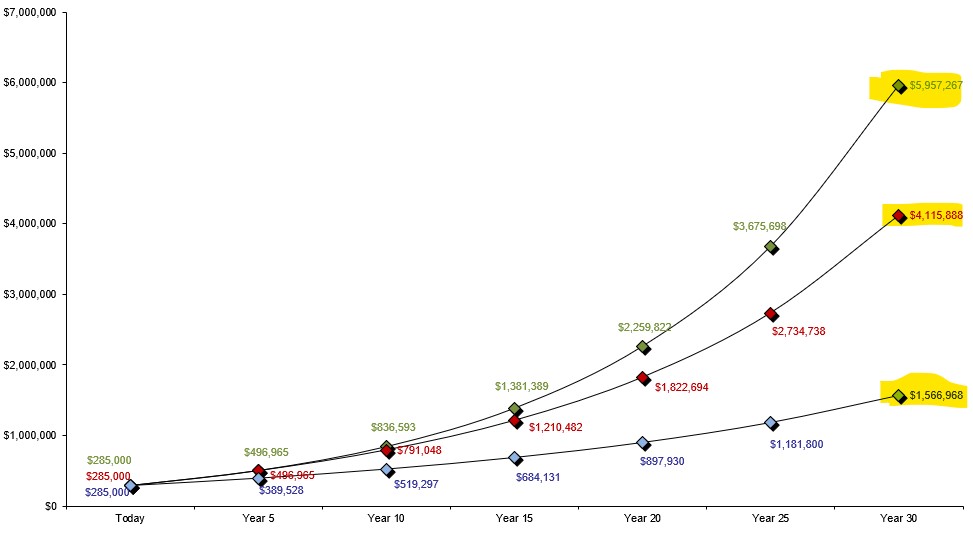

The truth is, the interest rate doesn't matter that much. "Whoa Greg, you're talking crazy. What have you been smoking?" I know, bold statement, right? Contradicts everything most people know about shopping for a loan. Probably makes those people a little uncomfortable that I could even make such a claim. I mean, we've been taught that rate is the most important thing to look for when buying a home. And, therefore, when you do find the cheapest rate and lowest fees then you've won. Saving $21 per month because you found a .125% lower rate on a $300,000 mortgage loan that you'll have for maybe five years (rough statistical average) puts you well on the way to millionaire status. ...Right? Not even close. Saving $21 per month on a mortgage you'll have five years means you saved about $1,800 in interest. Total. Do you know what the difference in your loan balance is at the end of those five years? $534. You'll have a whopping $534 more in your pocket when you sell your house in five years. "Yeah, Greg, but saving money is saving money." That's fair, so being that saving money is of primary importance then I assume you not only drive a low-budget economy car, but you also bought the cheapest low-budget economy car on the lot? You wear the cheapest clothes? When you go out to dinner you go only to McDonald's or Taco Bell? Or, if you do go somewhere fancier then surely you're not spending $12 on a glass of wine--wait, what, you drink 2 or 3 glasses? Oh. Well then surely you never waste money on jewelry or expensive vacations or clothes not bought from the thrift store or Botox or lip fillers or high-dollar shoes or over-priced Yeti coolers or high-tech electronics for your home then. And, of course, no doubt you own the Freedom 251 cell phone that costs about $4 instead of a $1,000+ iPhone. And coffee daily from Starbucks at $5 a cup when you could make it at home for $1? ...Pffft, no way, you wouldn't do that. I know I'm being a bit mordant here but to shop for the lowest bidder on the most important financial purchase of your life, to me, doesn't seem to be in one's best interest (no pun intended). Also, here's what I always wonder when people tell me they're shopping for the lowest rate ...how will they know when they've found it? When do you stop your search? And what if you make a decision, get the rate locked it in, but the next day or a week later rates are lower? What then? The lowest rate is an elusive target. Stop chasing it. The point is, people become very emotionally attached to their interest rate when they shouldn't because in the grand scheme, it matters very little. I can literally show you that in actual numbers if you're interested. What matters is acquiring appreciating assets, and putting your money to work making you money. I've spent 20 years in this business and I can tell you that most loan originators act as vending machines just spitting out rates and programs. That's not what I do. That's not what my clients deserve. I'm not the Dollar General of mortgage lending and I don't want to be. I want to provide value both during and long after the loan closing and that means more than just a low rate and a closed loan. That's the minimum every client expects. And I deliver that easily. But a mortgage is so much more than that as it relates to one's personal finances. Used strategically, your mortgage is the most powerful tool in your arsenal to actually helping you become a millionaire. I know because I've done it. And you know what the least important factor was in achieving that? The interest rate. Concern yourself with acquiring appreciating assets. As many of them as you can. That's how you get rich. You don't get rich saving a few nickels. Below is a screenshot of from a system I created called the Wealth Advisory System. The bottom highlighted number is what might be accomplished at the end of a 30 year mortgage by most people when they approach mortgage financing the way people are generally taught. The middle and top numbers are what I can show them how to achieve by using the mortgage as a tool to build wealth. But I can't do that if they go chasing a $21 month savings to work with young Johnny App Taker down the street or online. Having an advisor in your corner that you can trust can make a tremendous difference in your net worth, because how you borrow, or finance, your home has a far-reaching impact on every other aspect of your personal finances, including your ability to save, pay off debt, or retire when you want and how you want. As I've said for years - that's what I'm here for.

|

|